Structured Finance is a complex form of financing usually used on a scale too large for an ordinary loan or bond. Since deciding to work with Vanilla Financial I have 6 different policies from 5 companies covering my house car life health and income.

Structured Products Part 3 All About Structured Products

Often Vanilla Derivatives will be European-style options whose value at expiration will depend on that of some underlying asset.

Finance vanilla products. But I only have to work with 1 independent adviser who sourced and put in place the best policy in each class for me. VANILLA PRODUCT FINANCE is a financial instrument that describes it the holder either buys or sells an asset within a predetermined given time. Congress appears set to ignore President Obamas proposal that banks be required to offer plain vanilla financial products such as 30-year fixed-rate mortgages giving the banking industry.

Plain vanilla is used in various financial products as plain vanilla options plain vanilla swaps plain vanilla credit cards and so on. In financial derivatives terminology the term Vanilla Derivatives usually refers to relatively simple and common derivative contracts. At a hearing before the House Financial Services Committee Treasury Secretary Timothy F.

Plain vanilla is the most basic or standard version of a financial instrument usually options bonds futures and swaps. Having a collection of financial products but no clear path to financial freedom. As a product-first company we have built our team around people that have a passion for building beautifully designed products that make complex workflows as simple as they can be.

See option styleThe category may also include derivatives with a non-standard subject matter ie underlying developed for a particular client or a particular market. Collateralized debt-obligations syndicated loans and Mortgage-Backed Securities the C4 behind the 2008 financial crisis - are all examples of Structured Finance. The vanilla option is usually used as a hedging device that means it is a technique that is used to decrease the.

EurLex-2 In addition if a broad definition of structured bonds is adopted many financial products would lie between strictly plain vanilla and strictly structured. A quick comparison of their characteristics is given in the table below. In a nutshell plain vanilla means the most basic version of any product.

This complexity usually relates to determination of payoff. A standard option with no special or add-on features. From As viewpoint the movements of cash are these.

The simplest financial product is the plain vanilla bond. Investment and Finance has moved to the new domain. Lets look for instance at a 1 year 3 bond sold by B to A.

The holder has the right to buy or sell the asset without any obligation or interruption. Its products will mainly comprise corporate finance and plain vanilla capital market activities. Geithner announced that the administration had dropped one provision in its plan for a consumer financial protection agency a requirement for banks and other financial services companies to offer plain vanilla products like 30-year fixed mortgages and low-interest low-fee credit cards.

Products range from plain vanilla bonds to African currency bonds to uridashi issues that cater to our Japanese investor base Capital markets in Africa Why therefore is it that someone talking about mortgage lenders refers to the lack of esoteric products and there being only plain vanilla loans available and does not use more sensible words that wont confuse the vast majority of us. The term exotic derivative has no precisely. It is the opposite of an exotic instrument which alters the components.

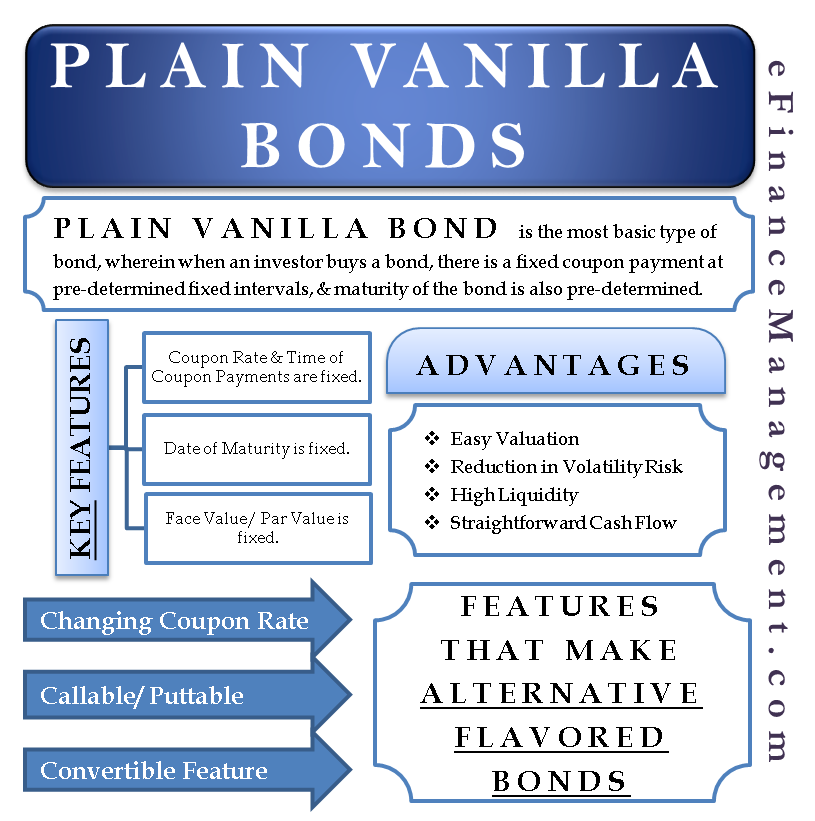

An exotic derivative in finance is a derivative which is more complex than commonly traded vanilla products. Under plain vanilla bonds fixed coupon payments are determined at regular intervals and maturity is also pre-determined. Generally vanilla products have standard and well-defined properties and trade actively.

Vanilla options are financial instruments that enable purchase or sale of an underlying asset at a pre-determined strike price inside a defined timeframe. Swaps exchanging one stream of future payments for another one possibly in two different currencies. There are three major categories of derivative instruments- options forwards and futures and swaps.

Vanilla has been modeled as a remote-first company since day one allowing us to work with the best people from around the world. There are many more kinds of financial products. The term plain vanilla can be applied to many financial products such as plain vanilla options plain vanilla swaps plain vanilla credit cards etc.

Binance Launches European Style Vanilla Options New Derivatives Product Offers Users Broader Portfolio Management For Traders And Issuers Binance Blog

Vanilla Option Overview Types Of Options Features

Passive Income Beginner S Guide Your Financial Toolkit Finance Breastfed Baby Baby New Baby Products

Vanilla Prices Could Rise As Cost Of Vanilla Bean Skyrockets

Plain Vanilla Bonds Meaning Features Example Advantages

Insurance Purchase To Get Simpler With Plain Vanilla Policies Details Here The Financial Express

/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

0 comments:

Post a Comment